The answer is surprisingly, “yes”! There was an interesting article on the National Association of Realtors‘ site that I thought I would share.

Marie Dinsmore, Certified Luxury Home Marketing Specialist

The Dinsmore Real Estate Team | www.dinsmoreteam.com

Marie@DinsmoreTeam.com | 770-712-7789

***

9 Surprising Things That Add Value to Your House

By: Dona DeZube

A home’s value is dependent on many things. Here are nine factors you might not have thought about.

1. Surf Breaks: Being within a mile of a surf break (a spot where surf-able waves happen) adds about $106,000 to a home’s value, according to surfonomics experts at the Monterey Institute of International Studies.

Reality check: Mother Nature makes surf breaks, so it’s not like you could build your own DIY break to boost your home’s value.

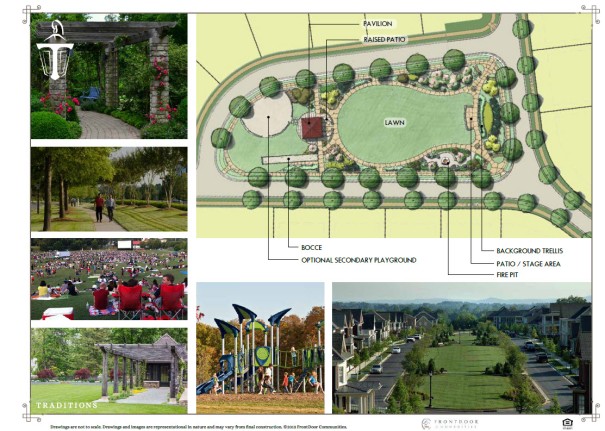

2. Parks and Open Spaces: A desirable public park or other recreational open space boosts the property value of nearby homes by 8%-20%. One study looked at 16,400 home sales within 1,500 feet of 193 public parks in Portland, Ore., and found these boosts to home values:

Reality check: A park that’s not maintained and overcrowded can drag down nearby home values.

3. Living Near a Walmart: Along with making it easier to run out for a gallon of milk  at midnight, researchers at the University of Chicago concluded that living within a mile of a Walmart store could raise your home’s value by 1%-2%, and living within half a mile could boost your property value by an additional 1%. For an average-size home, that’s an uptick of $4,000-$7,000.

at midnight, researchers at the University of Chicago concluded that living within a mile of a Walmart store could raise your home’s value by 1%-2%, and living within half a mile could boost your property value by an additional 1%. For an average-size home, that’s an uptick of $4,000-$7,000.

Realty check: What you gain in home value, you may end up spending at Walmart.

4. Solar Photovoltaic Systems: California homes with solar photovoltaic (PV) systems sell for a $17,000 premium over homes without solar systems, according to research from the U.S. Department of Energy’s Lawrence Berkeley National Laboratory.

Reality check: Although costs for residential solar power systems are falling, they’re still rather pricey at $15,000-$40,000, depending on the size of your house.

5. Walkability: Being able to stroll to schools, parks, stores, and restaurants will raise your property value anywhere from $4,000-$34,000, says a 2009 study from CEOs for Cities.

Reality check: The biggest boost in walkability values occurred in large, dense cities.

6. Accessory Dwelling Units: Whether it’s a granny flat, an in-law apartment, or a carriage house, having a separate unit can increase your home’s value by 25%-34%, according to a study of 14 properties with accessory dwelling units in Portland, Ore. You can also get a steady stream of income from a second unit.

Reality check: Local governments often ban accessory dwelling units, so check zoning laws, building codes, and homeowners association rules before you add a unit.

7. Professional Sports Arenas: A new pro sports stadium can raise property values in a 2.5-mile radius by an average of $2,214. The closer you are to the new facility, the larger the increase in home value. Researchers from the University of Illinois at Urbana-Champaign and the University of Alberta examined house sales in Columbus, Ohio, before and after the city added two sports stadiums.

Reality check: If a stadium is proposed, home values can decline a bit until the project is complete. And if you live really close to a stadium, you may encounter traffic and parking issues.

8. Community Gardens: Planting a community garden raises the value of homes within a 1,000-foot radius by 9.4% within five years, according to research by the Office of the Comptroller of the Currency and New York University School of Law. The impact increases over time, and high-quality community gardens have the greatest positive influence. Poor neighborhoods saw the biggest gains in home values.

Reality check: Gardens on privately owned land and in higher-income neighborhoods don’t have the same beneficial influence.

9. Trees: No real surprise here — whether trees are in your yard or just on your street, they’re a valuable asset you should be aware of. Here’s a gauge of how much trees are worth to your home value according to a University of Washington research survey:

- Mature trees anywhere in your yard: 2%.

- Mature trees on your street: 3%.

- Trees in your front yard: 3%-5%.

- Mature trees in high income neighborhoods: 10%-15%.

Reality check: Trees usually mean work — raking leaves, trimming branches, and keeping roots out of sewer lines.

at midnight, researchers at the University of Chicago concluded that living within a mile of a Walmart store could raise your home’s value by 1%-2%, and living within half a mile could boost your property value by an additional 1%. For an average-size home, that’s an uptick of $4,000-$7,000.

at midnight, researchers at the University of Chicago concluded that living within a mile of a Walmart store could raise your home’s value by 1%-2%, and living within half a mile could boost your property value by an additional 1%. For an average-size home, that’s an uptick of $4,000-$7,000.