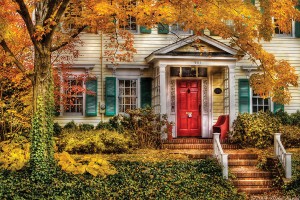

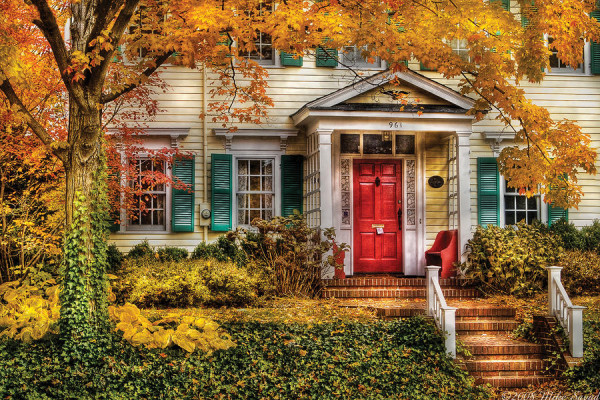

While the weather is still relatively warm in this part of the country, it’s hard to miss the whispers of fall that have begun to make their way into the rustling leaves and cool, crisp mornings. While autumn is characterized by a sort of sleepy transition into the frosty winter months, it’s also the perfect time to put a bit of effort into some do-it-yourself tasks that will have a positive impact on both the state of your home, as well as your wallet.

While the weather is still relatively warm in this part of the country, it’s hard to miss the whispers of fall that have begun to make their way into the rustling leaves and cool, crisp mornings. While autumn is characterized by a sort of sleepy transition into the frosty winter months, it’s also the perfect time to put a bit of effort into some do-it-yourself tasks that will have a positive impact on both the state of your home, as well as your wallet.

1.) GUTTERS: It’s not uncommon for most of us to overlook the true impact that gutters have on our property. Without a whole lot of aesthetic appeal, it’s easy to forget that they divert thousands of gallons of water from our homes on an annual basis. Unless you make a point to keep them clean, clogged gutters can lead to water in your home and an abundance of rust, rot, and corrosion. Therefore, before the foliage really begins to change, make a point to have your gutters thoroughly cleaned and covered with a mesh guard.

2.) STOP LEAKS: When it comes to energy costs, nothing can hurt your wallet like air leaks around windows and doors. Generally speaking, gaps in your weather stripping and caulk may actually add about 10% to your heating bill, so it’s important to look for leaks. For areas that appear to need your attention, replace any worn weather stripping or missing/damaged caulk and don’t forget to check around all electrical, cable, and phone entry points.

3.) DON’T NEGLECT YOUR ROOF: Instead of waiting until there’s water coming through your ceiling, it’s important to inspect your roof so that little annoyances are stopped before they become massive problems.

Start by inspecting your roof from top to bottom and looking for cracks and wind damage, as well as missing, broken, or curled shingles. While you’re up there, take a look into your gutters—if you notice large accumulations of granules, your roof may be shedding its coating, which means further issues are just around the corner.

4.) INSPECT YOUR FURNACE: While it may seem a bit redundant, it’s important to have your furnace inspected by a professional once a year. Again, while it may cost you a little bit of money, prevention will save you from having to shell out an abundance of money for large repairs and replacements.

On your own, pay attention to things such as noisy belts, erratic behavior, and general poor performance. All of these things can be signs that your parts are faulty, worn, or damaged, or that your heating ducts are blocked.

5.) STAY ON TOP OF GAS PROBLEMS: If you have a gas heater, keeping it in working condition is not only a cost issue, but a safety issue as well. Having a professional check it each year will not only save you money in operating costs, but help prevent poisonous gases from leeching into the air of your home.

6.) FIRE PROOFING: Sure, the likelihood of your home going up in flames is pretty slim; however, it happens and for anyone who has seen what a house fire looks like, the sight is truly horrific. Therefore, as we head towards winter and things like Christmas lights and trees, it’s important to take some extra steps to protect your family in case of a fire.

The first step involves not only replacing the batteries in each of your smoke detectors (don’t neglect your carbon monoxide detectors as well!), but testing them and making sure one is installed on every floor of your home—including the basement.

Next consider drawing up a few fire escape plans and make sure there’s no furniture or large items blocking any potential exits (to include windows). If you’ve found yourself accumulating things like old newspapers or leftover hazardous chemicals, be aware of the fact that they present an increased fire hazard, so getting rid of them will help keep your family safe.

CONCLUSION

In the end, keeping your home in working order throughout the winter doesn’t have to take a lot of time or money. If you stay on top of the little things and diligently complete them on an annual basis, then the chances that you’ll have to deal with large issues goes down exponentially.

Marie Dinsmore | The Dinsmore Team | www.dinsmoreteam.com | 770-712-7789

Developed through a partnership between The Providence Group and KM Homes, this spacious, upscale neighborhood provides elegant single-family homes starting in the low $600’s.

Developed through a partnership between The Providence Group and KM Homes, this spacious, upscale neighborhood provides elegant single-family homes starting in the low $600’s. Currently, Fall move-in dates are being offered and the new Providence Group Design Center is available to help buyers select their interior design options once they’ve settled upon one of our models that range from 3,400 to 5,292 square feet, or four to six bedrooms.

Currently, Fall move-in dates are being offered and the new Providence Group Design Center is available to help buyers select their interior design options once they’ve settled upon one of our models that range from 3,400 to 5,292 square feet, or four to six bedrooms.

When it comes to real estate and most forms of housing, the Fair Housing Act creates a blanket of sorts that envelops those looking to purchase or rent a residence. In essence, while there are still stipulations, race, color, national origin, religion, sex, familial status, or disability cannot be a deciding factor in things such as refusing to rent or sell housing, set different terms or conditions, or deny a dwelling.

When it comes to real estate and most forms of housing, the Fair Housing Act creates a blanket of sorts that envelops those looking to purchase or rent a residence. In essence, while there are still stipulations, race, color, national origin, religion, sex, familial status, or disability cannot be a deciding factor in things such as refusing to rent or sell housing, set different terms or conditions, or deny a dwelling.

As the second largest homebuilder in the United States, the Lennar Corporation has announced that they are securing the permits to build a large neighborhood of houses and townhomes just West of Cumming.

As the second largest homebuilder in the United States, the Lennar Corporation has announced that they are securing the permits to build a large neighborhood of houses and townhomes just West of Cumming.