Right off the bat, I understand that having a licensed Realtor write a blog about the reasons you should hire an agent may seem like a conflict of interest; however, I entered the complex world of real estate specifically because I believe that all current and future homeowners deserve to have someone in their corner when attempting to navigate the often confusing process of purchasing a home.

Right off the bat, I understand that having a licensed Realtor write a blog about the reasons you should hire an agent may seem like a conflict of interest; however, I entered the complex world of real estate specifically because I believe that all current and future homeowners deserve to have someone in their corner when attempting to navigate the often confusing process of purchasing a home.

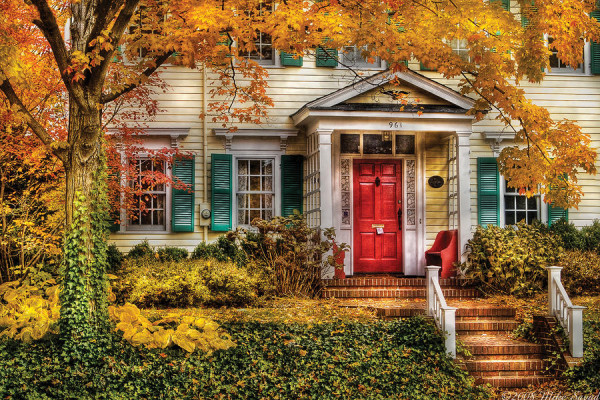

Plain and simple, with the over-abundance of technology flooding our consciousness every day, it’s no secret that searching for the perfect house has gotten easier. Right at your fingertips, there are thousands of homes with details about everything from neighborhood locations and prior purchase dates, to photos, virtual walk-throughs, and a variety of builder specifics. Gone are the days when you would have to spend hours driving through neighborhoods while collecting home fliers and scheduling dozens of showings—today, your access is instant.

Still, there’s a tried-and-true saying that is extremely pertinent in today’s market and it helps explain my list of reasons why you should hire an agent:

“Keep calm & let a Realtor handle it!”

1.) APPRAISERS – When it comes time for an appraiser to look at your home, it helps to have someone who can run interference and provide them with the comparable sales which were used to determine your home’s proper listing price (this is especially helpful if the appraiser is not familiar with your neighborhood).

2.) BRING EVERYONE TOGETHER – While you may not realize it, closing on a home requires a lot of parties to be on the same page—from the loan officer, inspector, and appraiser, as well as the buyer’s Realtor and closing attorney—which means a lot of behind the scenes work will need to take place before everything is settled. If you don’t want to see your deal fall apart before closing, it’s important to understand that a Realtor will keep things running smoothly.

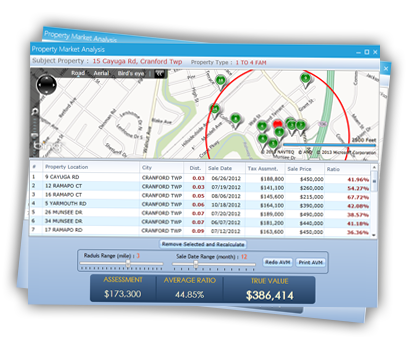

3.) THEY KNOW THE MARKET – When it comes to getting a fair property price, a Realtor who understands the area is imperative so you don’t wind up overpaying for a home. Plus, when it comes time for those nerve-wracking negotiations, an experienced agent will be able to fight on your behalf.

4.) SERVICE RECOMMENDATIONS – One of the great things about Realtors who have been in the business a while, is that they have a wealth of information about a myriad of service providers. From contractors and painters, to roofers, landscapers, and electricians, your odds are good that a Realtor will be able to send honest, good providers your way.

5.) GREATER ACCESS – Sure, the internet will help you see some of what’s available; however, to truly gain access to the listed homes in your area, you’ll need a Realtor. Otherwise, while you may be able to peruse “For Sale by Owner” homes on your own, it’s also important to note that those owners are NOT obligated to use sales contracts or disclosure forms (which protect you as the buyer) upon closing.

6.) CUTTING ACROSS STATE LINES – If you’re looking to move to another part of the country, a Realtor is imperative, especially if you aren’t familiar with where you’ll be heading. Instead of worrying about the unknowns, a local agent will be able to take note of adequate neighborhoods, schools, shopping venues, etc.

7.) EXTENDED REACH – If you’re considering listing your home on your own, it’s important to remember that this may drastically limit your pool of buyers. Realtors have an abundance of networking, advertising, and marketing resources at their disposal, so your home will sell that much faster.

In the end, an important bonus of working with a Realtor is that they will be there AFTER your sale is complete. It’s only natural for questions to arise weeks—or even months—after you sign those papers, so if you’ve been working with an agent, you can rest assured that you’ll never be left in a lurch.

If you’re looking to buy or sell your home, or if you simply need some advice about the current market in North Georgia, I would love to be of service to you.

Marie Dinsmore | The Dinsmore Team | www.dinsmoreteam.com | 770-712-7789

Developed through a partnership between The Providence Group and KM Homes, this spacious, upscale neighborhood provides elegant single-family homes starting in the low $600’s.

Developed through a partnership between The Providence Group and KM Homes, this spacious, upscale neighborhood provides elegant single-family homes starting in the low $600’s. Currently, Fall move-in dates are being offered and the new Providence Group Design Center is available to help buyers select their interior design options once they’ve settled upon one of our models that range from 3,400 to 5,292 square feet, or four to six bedrooms.

Currently, Fall move-in dates are being offered and the new Providence Group Design Center is available to help buyers select their interior design options once they’ve settled upon one of our models that range from 3,400 to 5,292 square feet, or four to six bedrooms.

When it comes to real estate and most forms of housing, the Fair Housing Act creates a blanket of sorts that envelops those looking to purchase or rent a residence. In essence, while there are still stipulations, race, color, national origin, religion, sex, familial status, or disability cannot be a deciding factor in things such as refusing to rent or sell housing, set different terms or conditions, or deny a dwelling.

When it comes to real estate and most forms of housing, the Fair Housing Act creates a blanket of sorts that envelops those looking to purchase or rent a residence. In essence, while there are still stipulations, race, color, national origin, religion, sex, familial status, or disability cannot be a deciding factor in things such as refusing to rent or sell housing, set different terms or conditions, or deny a dwelling.