Purchasing a home is arguably one of the biggest financial decisions you will make in your lifetime. As you start your hunt, don’t forget there will be other costs associated with your purchase than the price of the home. This is valuable information, especially for first-time homebuyers. These are all good reasons to hire an experienced Real Estate Agent to help navigate you through the process, plus the fact of multiple offers and homes now selling above listing price.

Here are 5 fees to keep in mind as you begin to budget.

- Home inspection. This is a crucial step in the home buying process. The findings that come from the inspection can help you negotiate price and repairs. Generally, you can expect to pay between $300 to $500 depending on the home and the location.

- Title services. Title services encompass the transfer of the title from the seller and a thorough search of the property’s records to ensure to no one will pop up with a claim to the property. Additionally, you may need to buy title insurance which will protect the lender or your investment in the home.

- Appraisal fee. Before getting a loan, you will likely be required to get an appraisal of the home to determine its estimated value. This will be conducted by a third-party company and the cost can land anywhere between $300 and $1,000, depending on the size of the home.

- HOA fees. Many communities have a homeowners’ association that enforces monthly fees. This money is used for general maintenance and updates to areas like pools, parks, and more. Typical HOA fees are around $200 per month.

- Taxes. The taxes each buyer pays at the closing table differ, but it is not uncommon for it to be up to two months’ worth of county and city property taxes. Additionally, there may be taxes for the transfer of the home title.

I would be happy to talk with you as you prepare to buy or sell and devise a plan to help you transition as smoothly as possible.

Sincerely,

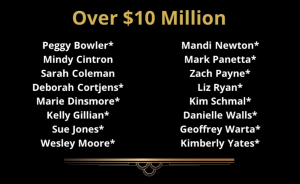

Marie Dinsmore

The Dinsmore Team

Experience, Passion, and Commitment to Excellence