Did you know that January is Radon Action Month? No? Well, are you even sure what radon is? If you’re like a lot of people, you may have heard about the hazards of radon in passing; however, whether you’re a homeowner or a renter, it’s important to be aware of what it is and why it matters to your life.

Did you know that January is Radon Action Month? No? Well, are you even sure what radon is? If you’re like a lot of people, you may have heard about the hazards of radon in passing; however, whether you’re a homeowner or a renter, it’s important to be aware of what it is and why it matters to your life.

Plain and simple, radon is a naturally occurring radioactive gas that is released by rock, soil, and water, which can build up to dangerous levels within any home. In the past, many people believed that homes built upon slab foundations were immune to this odorless, invisible gas; however, it’s important to note that it can be found within old or new homes, well-sealed or drafty homes, and homes with or without basements.

Breathing radon can greatly increase your risk of lung cancer, which has actually made it the number one cause of lung cancer among people who do not smoke. In fact, the Environmental Protection Agency estimates that radon causes more than 20,000 deaths from lung cancer in the U.S. each year.

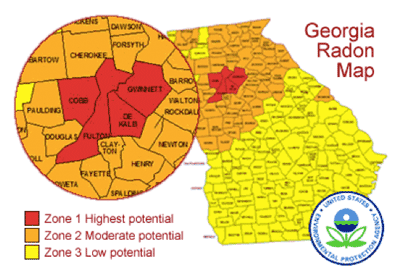

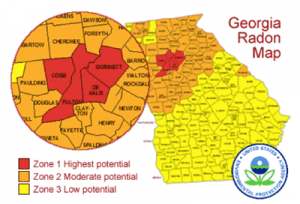

With this, it’s important to note that not only has radon been found in every state, but its levels can vary greatly between homes within the same area. In the United States, the average indoor radon level is about 1.3 pCi/L (picocuries per liter of air), while the average outdoor level is about 0.4 pCi/L. According to the EPA, it is recommended that people consider fixing their homes if their radon levels sit between 2 pCi/L and 4 pCi/L.

If it is discovered that your home contains high levels of radon, it’s not only possible to fix the problem, but it can be done for about the same cost as other common home repairs. While your personal situation will still depend upon how your home was built and how you use it, it’s important to note that testing for it is incredibly easy and incredibly worthwhile.

If you have questions about the process or you’re concerned about your home, I would love to put you in touch with a qualified inspector who can help keep you and your family safe.

Please do not hesitate to contact me.

Marie Dinsmore | The Dinsmore Team | www.dinsmoreteam.com | 770-712-7789